Switching within 90 days from date of purchase -Equitybalanced funds - 075 or minimum RM50 per transaction -Bond. Pb islamic asia strategic sector fund.

Helpful Tips For A Successful Unit Trust Investment

Switching after 90 days from date of purchase.

. Similarly there are specific rules regarding the switching of debt-oriented funds as well. Public islamic opportunities fund. Transfer fee to another PRS provider RM25 for each transfer request.

Switching is allowed among all funds approved under the EPF Members Investment Scheme. Unit holders can switch units from one fund to another managed fund assuming that these units are available for sale. Public Mutual fund performance chart at.

View details and features of funds and compare performance of funds over selected periods. 125 per annum of the NAV. Public Mutual New Switching Fee Structure 1.

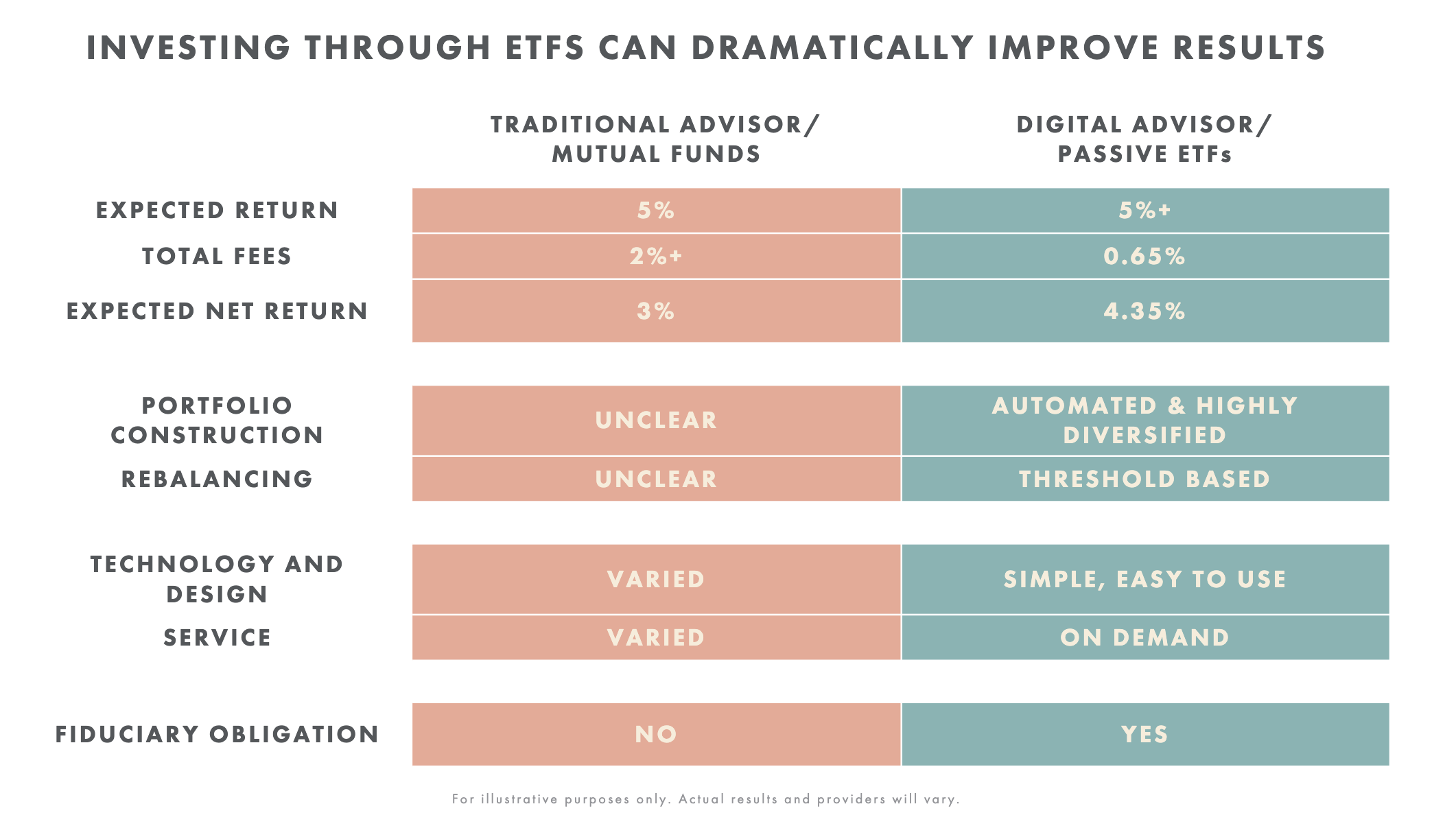

The problem is that the funds will generally have a 2 3 management fee MERs. Public Mutual UTC Connect is an online facility as such you may be exposed to the risks associated with hardware and software failure. Dollardex Online Unit Trust Platform Singapore All mutual funds have fees.

Invest in our e-Series of Funds with a minimum initial investment of only RM100 and sales charge of up to 375 of Net Asset Value NAV per unit. Public global select fund foreign. If you only invest RM1000 RM25 is 25 of your total investment.

So this strategy is only workable if you are investing more than RM2500. Switching equity funds before one year of the investment is complete results in 15 taxation on capital gains. Public islamic asia dividend fund.

For a share trading investment the Government charges a stamp duty of RM1 for every RM1000 worth of share value. Public Mutual Berhad a wholly-owned subsidiary of Public Bank. Subject to RM25 per switching Except you are Mutual GoldElite Who invest more than RM100K in Public Mutual.

In Principals dashboard you will be able to view your cash scheme account s invested via EPF Akaun 55 and Akaun Emas. Assume is normal bond fund low loaded pay 05 sales charge 025 or minimum rm50 u gonna pay u can check it in prospectus. Public Mutual Switching Fee.

Switching from equitybalanced funds will be subject to switching fee of 075 or minimum RM50 per transaction. Public Mutual Berhad Company No. Eng Hua switching fee definitely lower than the amount transacted and lower than the service charge.

10 per annum of the NAV. Usually if you are charged a switching fee you would not be charged initial sales charges for that transaction. Thanks but what if i switch from bond to money market within 90 days.

The saving of 105 is RM2625. However the online switching facilities for cash scheme account are not available yet. If you have registered your mobile phone number your PAC can be requested via Public Mutual Online PMO and the 8-digit authentication code will be sent to your mobile phone via SMS.

Meantime you may walk into any Principals branches neareast to you to submit any switching request. Clearing fee is charged by Bursa Malaysia as the clearing house and typical fee is 003 of the investment value. Public islamic asia leaders equity fund.

Class A Class B and Class C Units are distinguished by the amount of Sales Charge Redemption Charge switching fee transfer fee and amount of management fee imposed by the Provider on each of those classes of Units. Switching fee Payable to the distributor when you switch from one fund to another fund managed by the same fund manager. Public Mutual Berhad a wholly-owned subsidiary of Public Bank is a top private unit trust management company and leading PRS provider in Malaysia.

Switching Fee between funds in another PRS managed by Public Mutual Nil. It is just enough to cover the switching fees. 197501001842 23419-A values your privacy and strives to protect your personal data in compliance with the laws of Malaysia.

Enjoy waiver of switching fee for up to 15 switches of loaded units and 1-load units which are made after 90 days from the date of purchase subject to terms and conditions. Switching from bond funds will be subject to switching fee of 025 or minimum RM50 per transaction. As a general rule of thumb you can expect an independent financial advisor to receive between 3 and 4 commission on an investment.

We offer a comprehensive range of products comprising conventional and Shariah-based unit trust and PRS funds as well as financial planning services. The minimum investment that can be switched in each transaction is RM1000 and units switched are transacted at the funds NAV per unit. Which is RM25 in Public Mutual While there is no exit fee if you choose to re-enter again it will cost you another round of service charges.

RM580 x 1000 units RM5800. Which is 3 plus GST in Public Mutual The only instance when there is no difference btw switching or selling is when there is no switching fee and zero service charge. Typically about 1 of your investment.

The noncore fund of the Scheme has 1 class of Unit. Upfront charges for wrap accounts. Public asia ittikal fund.

In switching it might cost you a switching fee. Phillip Mutual Berhad and Maybank2u. Service Charge will be imposed for switching of low-load units of bondmoney market funds into equity and balanced funds.

Switching from money market funds will be subject to switching fee of RM50 per transaction. Therefore if you invest 100K with your advisor in mutual funds he will make between 3 and 4K. RM5800 x 07 RM4060.

160 per annum of the NAV. The switching fees is RM25 per switch. A switching fee of RM25 per transaction will be deducted from the switching amount except for switching into money market funds.

150 per annum of the NAV. However if you switch after one year of investment the transfer is tax-free. Switching fee between funds in this Scheme Nil.

For customers who are overseas you must have a Malaysian mobile service number and access to international call roaming service. Timing is also a matter to consider.

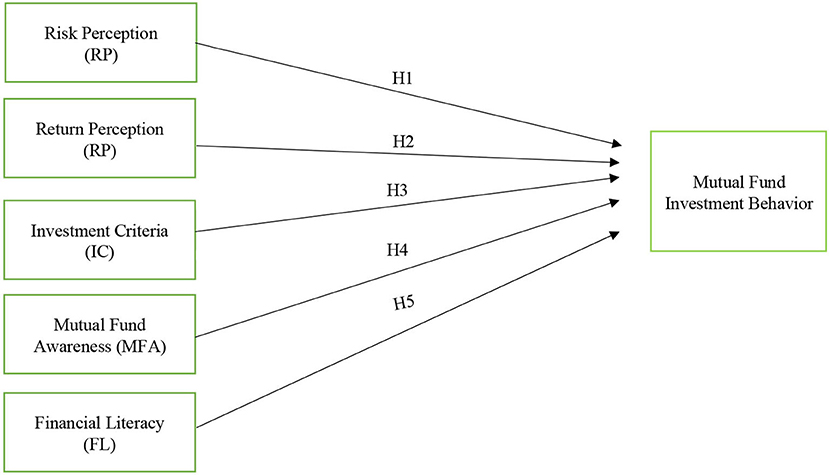

Frontiers Determinants Of Investment Behavior In Mutual Funds Evidence From Pakistan Psychology

Pin By Ame On Seiyuu Butai Pie Chart Insight Chart

Nasdaq Teams With Seb For Blockchain Mutual Fund Trading Trial Crypto News News Trading Business News Capital Markets Security Token Nasdaq Cryptocurrency News

Regular Investment Authorisation Ria

Mutual Funds What They Are How To Invest Wealthsimple Wealthsimple

3 Practical Strategies Of Unit Trust Investment Investing Finance Blog The Unit

Difference Between Epf And Ppf Income Investing Investing Basic

5 Simple Rules To Switch Mutual Funds Complete Guide

Pin By Marleocat On Bancos Helping People Bank Lasalle

How Do I Exchange A Vanguard Mutual Fund For Another Vanguard Mutual Fund Online Vanguard

Cloud Computing A New Paradigm In The It Industry Cloud Computing Cloud Computing Services What Is Cloud Computing

/GettyImages-1095405506-13934030dd0744dfb71001554e2e53e3.jpg)

The Abcs Of Mutual Fund Classes

When Is It A Good Time To Exit Your Mutual Fund Investments

The Times Group Financial Planner Financial Planning Financial Guru

Mutual Fund Basics Ameriprise Financial

Save On Your Car And Home Insurance Policy Up To 854 Health Insurance Plans Home Insurance Insurance Policy

Knowandask About Iptv Versus Ott Knowandask Video On Demand Cloud Services Streaming Media

7 Things To Do When Losing Money In Mutual Funds